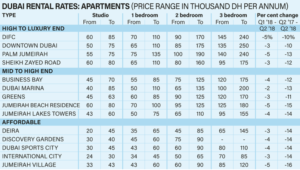

Where Dubai and Abu Dhabi rents have risen and fallen, Q2 2018

Tenants in Dubai continued to experience lower rental rates in the second quarter – by as much as 15 per cent year on year in some areas.

Rents have been falling for the past three years on the back of lower oil prices and growing supply, and, although oil prices have recovered in the past few months, inventory volumes in Dubai have made sure that landlords have had to reduce their expectations.

There was an overall quarterly drop in apartment and villa rental rates of 3 per cent and 2 per cent respectively, according to property company Asteco.

“Vacancy levels in many projects rose as a result of the additional inventory, although some locations and/or developments were able to maintain good occupancy rates, particularly those properties with proactive management and maintenance teams,” it said in its Q2 report. “Landlords offering discounts and/or other incentives also facilitated tenant retention.”

It said 3,400 units were delivered in the April to June period with the majority of supply along the growth corridors of Sheikh Mohammed Bin Zayed Road and Emirates Road. It anticipates 25,000 handovers in total in 2018.

Apartments in areas such as Palm Jumeirah, Jumeirah Beach Residence and Dubai Marina all saw double digit falls year on year.

Market sentiment could improve on the back of a number of recent announcements, according to John Stevens, managing director of Asteco.

He highlighted the freezing of school fees for the 2018/19 academic year, the introduction of a 10-year residency visa for investors and specialists, and 100 per cent foreign ownership of companies outside free zones.

_____________

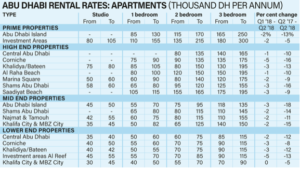

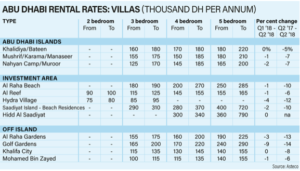

Abu Dhabi

It was a similar story in the capital where rents declined by as much as 10 per cent year on year.

Rental rates softened by 2 per cent quarter on quarter for apartments, and 4 per cent for villas.

About 1,000 units came to the market in Q2, the majority of which was on Reem Island, Asteco said. Another 5,800 units are planned for the remainder of the year.

The biggest drops in the villa market were recorded in Golf Gardens – 14 per cent – and Al Raha Gardens – 13 per cent – while high end apartments on the Corniche fell 16 per cent.

A recent report from consultancy Cavendish Maxwell painted a similar picture to that of Asteco.

“Since the beginning of the year, tenants have had increasing flexibility to either negotiate rents down during renewal or migrate between communities as lower rents and increasing vacancy levels have made historically expensive locations accessible to a wider segment,” its report stated.